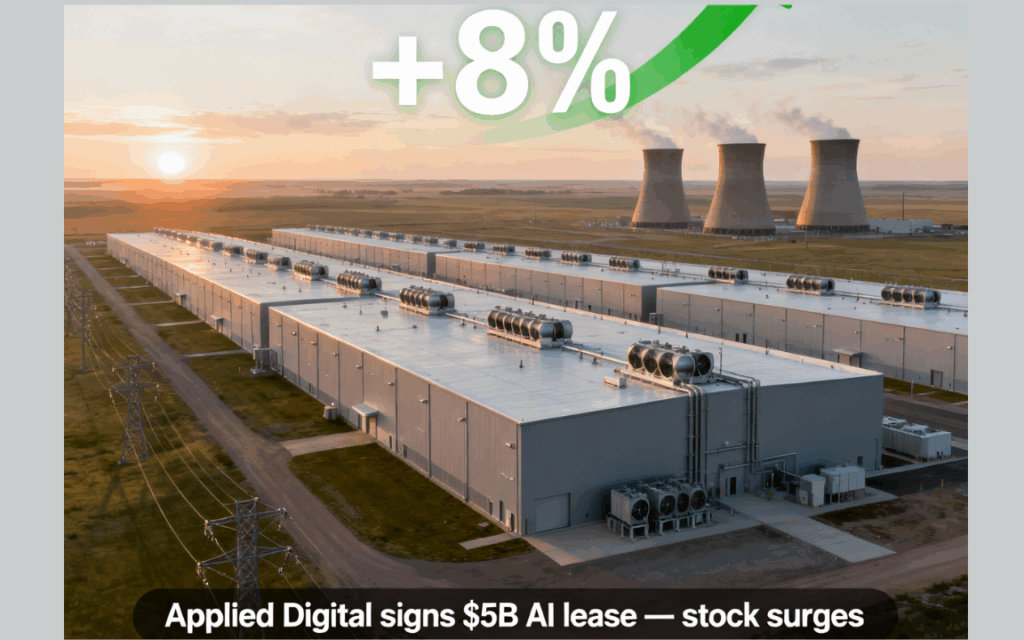

Applied Digital stock (Nasdaq:APLD) soared on Wednesday after the company signed a roughly $5 billion, 15-year AI compute lease with a major US hyperscaler for 200 MW of capacity at its Polaris Forge 2 campus in North Dakota.

The deal increases the company’s committed AI footprint to 600 MW across its Polaris facilities, bolstering contracted revenue visibility.

Shares jumped in premarket trading amid heightened demand for large-scale AI compute infrastructure.

Applied Digital stock pops as investors chase AI capacity build-out

Applied Digital stock opened sharply higher in US premarket trading on Wednesday, rising more than 8 percent on news of the 200 MW lease extension.

Year to date, the stock has climbed roughly 325 percent as investors have sought exposure to firms supplying power and real estate for AI workloads.

Market participants cited the sheer scale of commitments as a key driver of the rally.

Earlier this year, Applied Digital inked its first hyperscaler deal, leasing 150 MW to CoreWeave at Polaris Forge 1.

That transaction marked the company’s entry into the hyperscaler market and underscored the accelerating pace of capacity commitments.

With the Polaris Forge 2 lease, total leased capacity now stands at 600 MW, up from zero at the start of 2024.

The latest agreement adds nearly $5 billion in contracted revenue over 15 years and improves visibility into free cash flow generation once facilities reach full utilization.

Analysts note that capacity utilization is expected to rise steadily as construction and commissioning across Polaris sites continue through 2026, supporting revenue growth and reducing reliance on spot leasing arrangements.

Analysts say hyperscaler deals validate AI infra thesis

Industry analysts view the Applied Digital contracts as confirmation that hyperscale customers are prioritizing long-term capacity commitments with specialized data center providers.

The AI infrastructure arms race has pushed hyperscalers to lock in power and real estate now, securing dedicated facilities amid global supply constraints.

Long-duration leases provide a recurring revenue stream and act as a competitive moat, according to sector research notes.

However, risks remain: dependence on a limited number of large customers could expose Applied Digital to concentration risk if demand softens.

Additionally, the power, land, and capital expenditure required to build out the Polaris network present execution challenges.

Wall Street comparisons have focused on peers such as CoreWeave, QTS, and EdgeConneX, highlighting differences in geographic footprint and long-term contracted revenue as key differentiators.

While CoreWeave has grown through smaller, incremental leases, Applied Digital’s bulk commitments offer clear revenue visibility but carry higher upfront capital allocation.

Overall, analysts say the deal underscores the essential role of specialized AI data centers in meeting surging compute needs.

The post Applied Digital stock surges after $5B AI contract: here’s all you need to know appeared first on Invezz